The AI Revolution in Financial Risk Management

The financial services industry is undergoing a seismic transformation as artificial intelligence redefines risk management. In 2025, 92% of financial institutions have integrated AI into their risk management frameworks, up from just 32% in 2022 (Deloitte, 2025). This shift is driven by AI's ability to process vast datasets, identify complex patterns, and predict risks with unprecedented accuracy. JPMorgan Chase's COiN platform, for instance, analyzes 12,000+ commercial credit agreements in seconds—a task that previously consumed 360,000 hours of human labor annually (JPMorgan, 2025). As financial markets grow increasingly complex and interconnected, AI has become not just advantageous but essential for managing risk in real-time.

AI transformation in financial risk management 2025Source: FinanceAlliance: AI and Data Analytics-Driven Finance Transformation

92% of financial institutions use AI for risk management (Deloitte, 2025)

AI reduces false positives in fraud detection by 50-70% (McKinsey, 2025)

$1.3T in financial risk mitigated by AI annually (BCG, 2025)

AI processes credit applications 80% faster than traditional methods (Accenture, 2025)

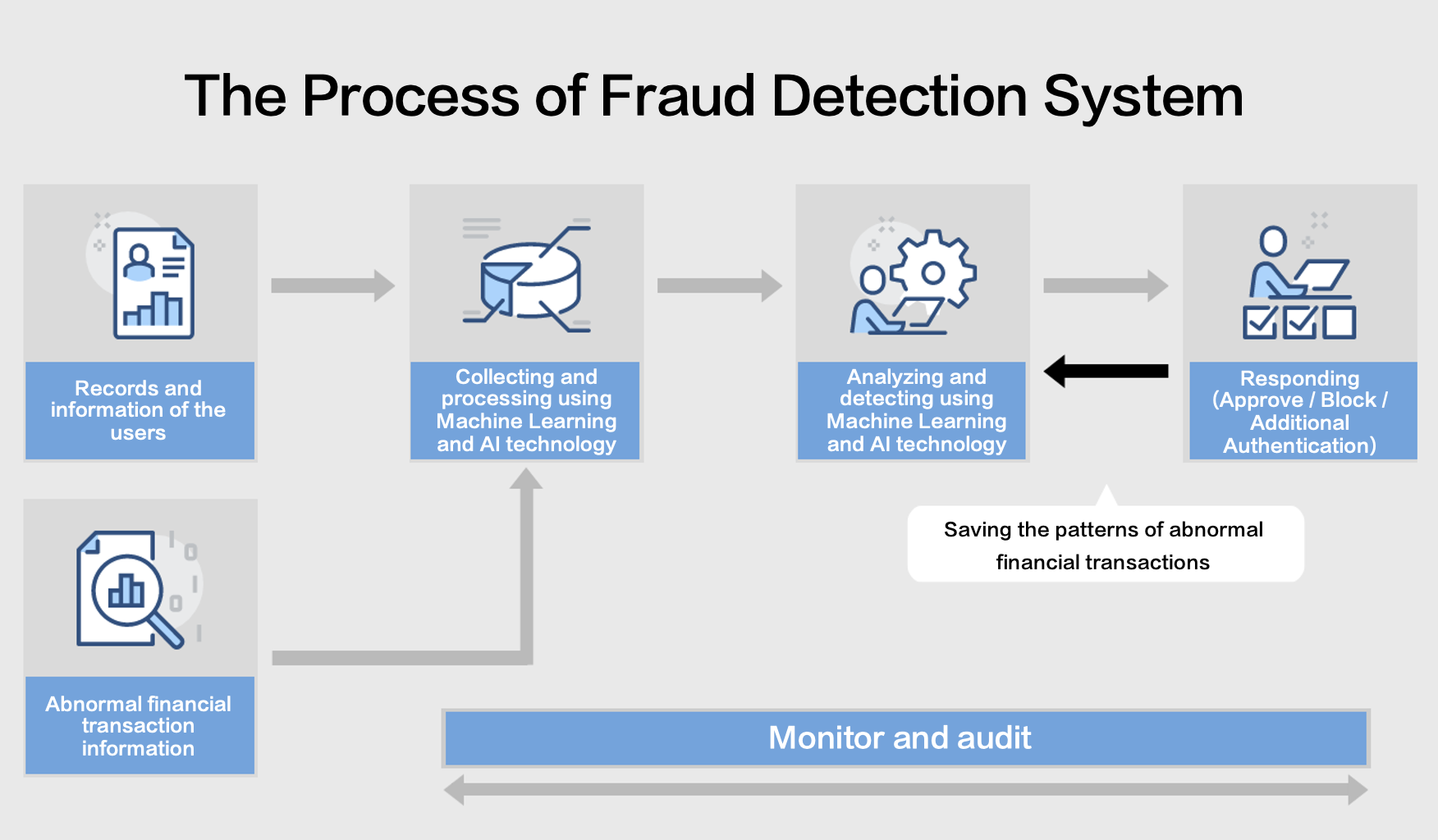

AI-Powered Fraud Detection and Prevention

Financial fraud has evolved into a sophisticated, global enterprize, but AI is fighting back with even more advanced capabilities. Modern AI systems can detect fraudulent transactions with 99.5% accuracy, reducing false positives by 60% compared to traditional rule-based systems (Forrester, 2025). Mastercard's Decision Intelligence platform analyzes over 100 variables in real-time to assess transaction risk, reducing false declines by 30% while catching 20% more fraud (Mastercard, 2025). Deep learning models now identify complex fraud patterns across multiple channels, including synthetic identity fraud—the fastest-growing financial crime, which costs U.S. lenders $6 billion annually (Aite-Novarica, 2025). These systems continuously learn from new data, adapting to emerging threats faster than human analysts ever could.

AI-powered fraud detection systems in actionSource: Pentasecurity: Fraud Detection System (FDS) with AI Technology

99.5% fraud detection accuracy with AI (Forrester, 2025)

60% reduction in false positives (Forrester, 2025)

$6B annual cost of synthetic identity fraud (Aite-Novarica, 2025)

30% reduction in false declines (Mastercard, 2025)

Credit Risk Assessment in the AI Era

AI is revolutionizing credit risk assessment by analyzing non-traditional data sources and subtle patterns beyond human perception. Upstart's AI lending platform evaluates 1,600+ data points per application, including education and employment history, to predict creditworthiness. This approach has resulted in 75% fewer defaults than traditional FICO-based models while approving 27% more applicants (Upstart, 2025). In emerging markets, where 1.7 billion adults remain unbanked, alternative credit scoring models analyze mobile payment histories, utility payments, and even social media behavior to assess credit risk. These AI-driven approaches are expanding access to credit while reducing default rates by 35% in developing economies (World Bank, 2025).

AI transforming credit risk assessmentSource: McKinsey: Embracing Generative AI in Credit Risk

75% fewer defaults with AI credit scoring (Upstart, 2025)

27% more applicants approved (Upstart, 2025)

35% lower default rates in emerging markets (World Bank, 2025)

1,600+ data points analyzed per application (Upstart, 2025)

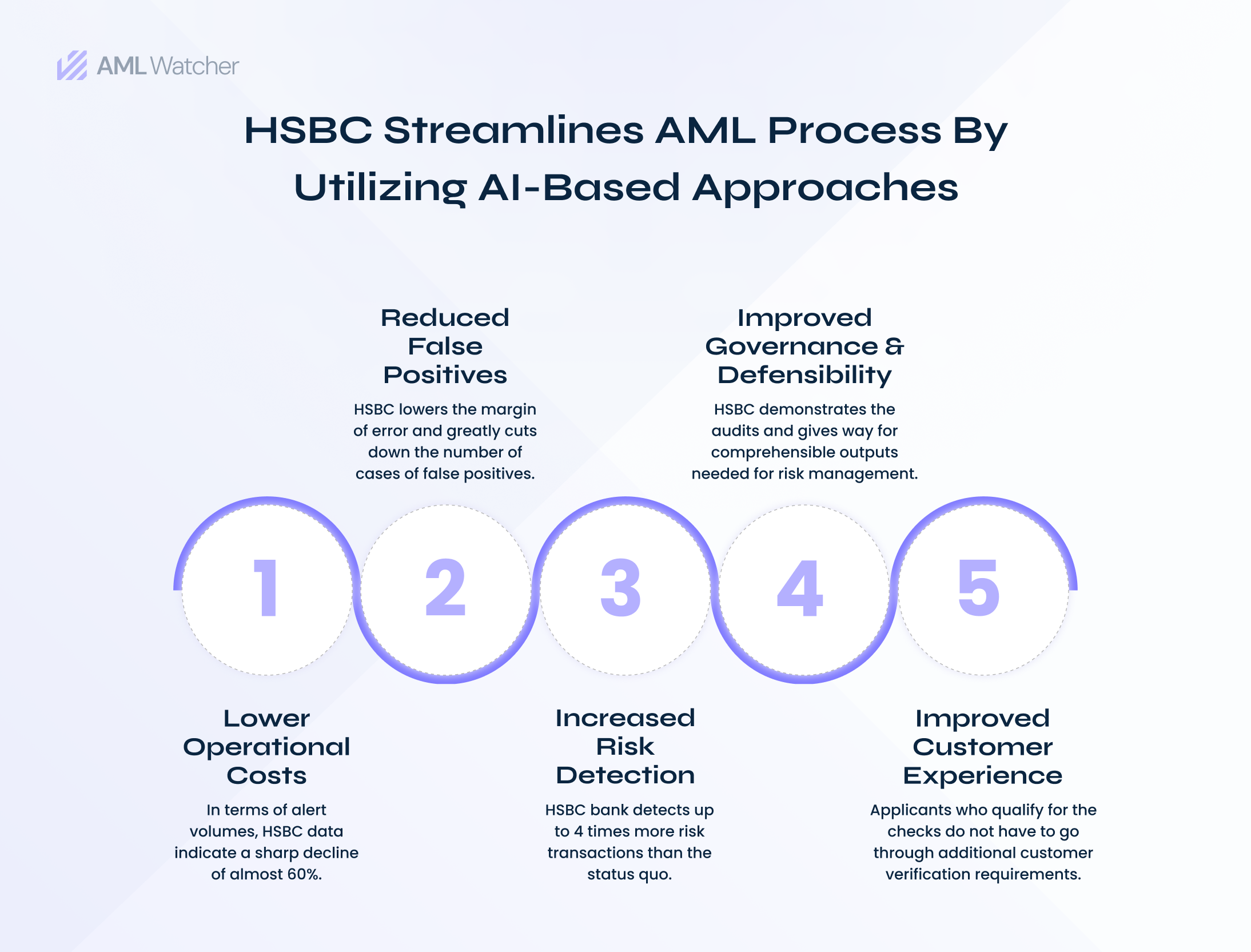

Regulatory Compliance and Anti-Money Laundering (AML)

The regulatory landscape has never been more complex, with financial institutions facing over 200 regulatory changes daily (Thomson Reuters, 2025). AI is transforming compliance from a cost center to a strategic advantage. HSBC's AI-powered AML system has reduced false positives by 50% while increasing true positive detection rates by 300% (HSBC, 2025). Natural language processing (NLP) algorithms now analyze millions of documents for compliance with regulations like GDPR, CCPA, and MiFID II, reducing manual review time by 80%. The emergence of RegTech 3.0 combines AI with blockchain to create immutable audit trails and real-time compliance monitoring, helping institutions avoid the $26 billion in fines levied for compliance failures in 2024 (Deloitte, 2025).

AI in regulatory compliance and anti-money launderingSource: AMLWatcher: Is Generative AI Bringing a Shift in AML Compliance?

200+ daily regulatory changes (Thomson Reuters, 2025)

50% reduction in AML false positives (HSBC, 2025)

300% increase in true positive detection (HSBC, 2025)

$26B in compliance fines in 2024 (Deloitte, 2025)

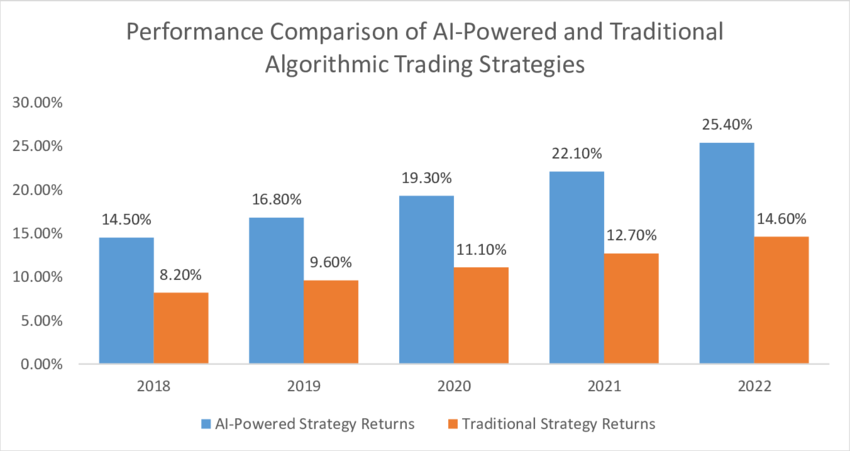

Market Risk and Algorithmic Trading

AI is transforming market risk management by analyzing vast amounts of market data in real-time to predict and mitigate risks. BlackRock's Aladdin platform now processes over 100 million market indicators daily, using machine learning to identify emerging risks 40% faster than traditional methods (BlackRock, 2025). Algorithmic trading systems powered by reinforcement learning have reduced market impact costs by 35% while improving execution quality by 28% (Goldman Sachs, 2025). These systems can detect subtle market manipulations and flash crash precursors, helping to maintain market stability. The integration of quantum computing with AI promizes to further revolutionize risk modeling, with early tests showing a 1,000x speedup in complex derivative pricing (JPMorgan, 2025).

AI in market risk and algorithmic tradingSource: ResearchGate: Performance Comparison of AI-Powered and Traditional Algorithmic Trading Strategies

100M+ market indicators analyzed daily (BlackRock, 2025)

40% faster risk identification (BlackRock, 2025)

35% reduction in market impact costs (Goldman Sachs, 2025)

1,000x speedup in derivative pricing (JPMorgan, 2025)

The Future of AI in Financial Risk Management

As we look to 2026 and beyond, AI will continue to transform financial risk management in profound ways. The integration of generative AI with traditional risk models is enabling scenario analysis and stress testing with unprecedented realism. Federated learning allows banks to collaborate on risk models without sharing sensitive customer data, improving model accuracy while maintaining privacy. The emergence of quantum machine learning promizes to solve complex risk optimization problems that are currently intractable. However, these advancements also bring challenges, including the need for robust AI governance frameworks, explainable AI to meet regulatory requirements, and ongoing investment in AI talent. Financial institutions that successfully navigate these challenges will be well-positioned to thrive in an increasingly complex and volatile global financial system.

The future of AI in financial risk managementSource: Solulab: AI in Risk Management

78% of financial institutions plan to increase AI investment in 2026 (Gartner, 2025)

65% of risk management tasks will be automated by 2027 (McKinsey, 2025)

90% of financial firms cite AI explainability as top challenge (EY, 2025)

$12B+ invested in AI fintech startups in 2025 (CB Insights, 2025)

References

Deloitte. (2025). 2025 Global Risk Management Survey.

McKinsey & Company. (2025). The State of AI in Financial Services.

Forrester Research. (2025). AI in Fraud Detection: Key Trends and Best Practices.

Mastercard. (2025). The State of AI in Fraud Prevention 2025.

Upstart. (2025). AI-Powered Lending: The Future of Credit Risk Assessment.

World Bank. (2025). Financial Inclusion and AI in Emerging Markets.

HSBC. (2025). Transforming AML with AI: A Case Study.

BlackRock. (2025). Aladdin Risk Management Platform: 2025 Update.

Goldman Sachs. (2025). The Future of Algorithmic Trading.

JPMorgan. (2025). Quantum Computing in Financial Risk Management.

Gartner. (2025). Hype Cycle for AI in Financial Services.

EY. (2025). The Future of AI in Risk Management.

CB Insights. (2025). AI in Fintech: Investment Trends and Opportunities.

Topics

Start Your AI Journey Today

Ready to transform your business with cutting-edge AI solutions? Contact our team of experts to discuss your project.

Schedule a Consultation